Highlights

- Liberty is a tech company disguised as an oilfield services firm. Technology innovations are helping the company increase production, lower costs, and enhance environmental, social, and governance (ESG) performance.

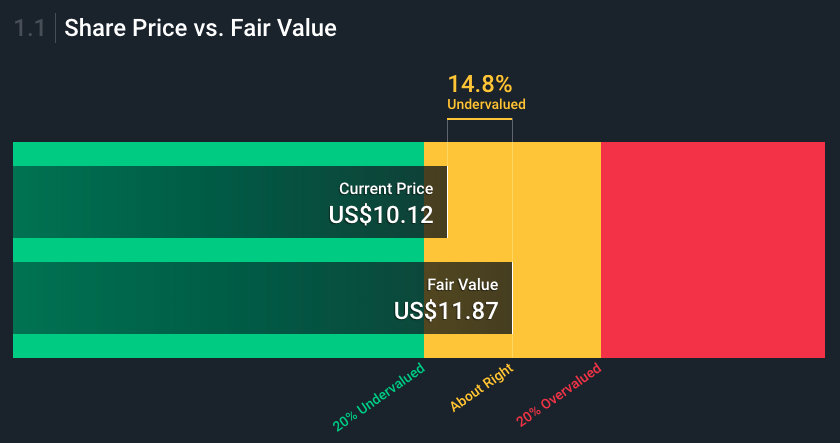

- Liberty annual earnings are projected to grow nearly 80% over the next 3 years. Its stock price (US~$10) on 12/9/21 is ~15% undervalued.

- Liberty has provided a 24% average cash return on capital invested over 9 years.

Liberty Oilfield Services (NYSE: LBRT) is undervalued and positioned for growth. Liberty offers fracking services to energy companies across North America. A method of extracting oil and natural gas, fracking involves drilling into the ground and applying fluids under high pressure to release the oil and gas contained in underground rock formations. But don’t be fooled by simplistic job descriptions. Liberty is actually a tech company disguised as an oilfield services firm.

Liberty’s outspoken CEO, Chris Wright, unapologetically highlights the critical role oil and gas play in pulling people out of poverty, reducing environmental harm, and fueling the benefits of modern life.

Wright first grabbed my attention when he made this video highlighting the hypocrisy of North Face, which makes high-quality outdoor recreation gear. North Face refused to make a co-branded jacket with one of Liberty’s competitors, an oil and gas company. Chris exposed this silly act of virtue-signaling by buying ad space on billboards near North Face’s headquarters to point out that their products are made with the help of the oil and gas industry.

Chris does not come from a traditional industry background. He’s a self-described “energy nerd” who studied mechanical and electrical engineering at MIT and UC Berkeley and worked on nuclear fusion. His first company, Pinnacle Technologies, helped launch commercial shale gas production in the late 1990s. Chris started Liberty in 2011, and in the past ten years, the company has grown to a $1.7 billion market capitalization and ~2,500 employees. Liberty, which had its IPO in 2017, is headquartered in Denver, Colorado.

Liberty’s technology advantage

Liberty’s technology portfolio includes ~500 patents and strategic acquisitions to raise productivity and lower costs, and it has helped customers reduce the cost to produce a barrel of oil by more than 65% over the last eight years, according to Liberty’s 2020 annual report. The company’s quest for increasing productivity delivers lower emissions and boosts environmental, social, and governance (ESG) performance.

Liberty’s data-rich ESG report is not the typical “we are less bad” report full of greenwashing, buzzwords, and empty promises. It looks instead at a bigger picture of our world and describes the positive impact Liberty and the industry make on energy access, healthcare, education, transportation, communication, and economic growth.

Here’s a sample of some of the technology innovations helping Liberty increase production, lower costs, and enhance ESG performance.

- Liberty introduced “FracSense,” a diagnostic service to help customers acquire more accurate well data to optimize hydraulic fracture completions and well spacing.

- Liberty set a record for a 24-hour period of continuous pumping using real-time data tracking, predictive analytics, and supply chain and logistics integration.

- Liberty developed “Quiet Fleet” technology to reduce noise emissions during hydraulic fracturing operations by a factor of 3 compared to a conventional fracturing fleet.

- Liberty acquired PropX, a provider of delivery equipment, logistics, and software solutions to drive efficiency and reduce noise and emissions.

- Liberty acquired Schlumberger’s onshore hydraulic fracturing business in the United States and Canada including proprietary controls, novel software, and fleet automation.

- Liberty is in the process of launching electric frac pumps with 40% more horsepower and 25% lower emissions than conventional technologies.

Outlook

Liberty’s annual earnings are projected to grow nearly 80% over the next three years. And its current stock price (US~$10) is currently ~15% undervalued (on 12/9/21), according to stock market analysts.

Natural gas will be the biggest winner in the energy sector over the next decade. The demand for energy continues to outpace supply, as evidenced by the current energy crisis in Europe and China. Underinvestment in global oil and natural gas production has led to higher energy prices and shortages. Increasing demand, policies aimed at reducing climate risk, and current market incentives will likely make the supply shortage last through this decade because it’s clear we’re going to need a lot more energy than we’re generating now. Energy runs on a predictable cycle like other commodities, and we are at the beginning of a new cycle.

The world is moving to natural gas because it’s reliable, affordable, and emits fewer greenhouse gases than the alternatives. Contrary to what many investors think, the biggest greenhouse gas reductions over the past 15 years are not related to increased solar and wind power but to shifts away from coal and toward natural gas. (I explain more about this in another article.) Natural gas produces about half the carbon dioxide and just one-tenth of the air pollutants that coal does.

All of these conditions mean Liberty is well positioned for growth.

Risk analysis

ESG mandates and investor pressure are the greatest threats to the oil and natural gas industry. Many investors and politicians don’t understand the energy system and are confused by the myriad messages they’re hearing about renewable energy and climate risk. Concerns about climate risk have led to corporate and government incentives that channel money away from oil and gas production. These incentives may impact the cost of capital, which will put American oil and gas companies at a disadvantage. S&P Global Ratings estimates funding costs were about 75 basis points higher on average for the most carbon-intensive borrowers from the North American energy sector.

In addition, the U.S. oil and gas industry will likely face more regulation. In fact, the Environmental Protection Agency (EPA) announced new rules in November 2021 that strengthen regulations on new oil and gas wells. If a carbon tax is imposed in the future, it will negatively impact the value of U.S. oil and gas companies. President Biden’s orders to halt oil and natural gas leases on public lands and waters can also hurt U.S. industry. These efforts to curb planet-warming carbon emissions are counterproductive and may lead the U.S. to import energy from countries with less strict environmental regulations—something that will increase greenhouse gas emissions.

Although the regulatory efforts will be counterproductive, they can still negatively affect the U.S. oil and gas industry. In addition, geopolitics can have a huge impact on the supply and price of energy. Economic sanctions on energy-rich countries like Iran, Russia, and Venezuela can quickly move the global energy market up or down.

Liberty is not immune to macroeconomic forces like higher transportation costs, driver scarcity, and labor shortages caused by Covid-19. West Texas Intermediate (WTI) oil prices dropped as low as $18 per barrel in the spring of 2020, and supply chain disruptions, materials shortages, labor scarcity, and rising costs all eat away at margins.

Despite these risks to oil and gas companies, the truth is that solar and wind provide less than 3% of global energy after two decades and $2 trillion invested, including heavy subsidies. The world currently runs on 84% hydrocarbons. People are going to continue to need hydrocarbons to meet their energy needs for many decades, and unless Americans are going to give up air conditioning, heating, driving, computers, and flying in airplanes, we are going to continue to use oil and gas.

And as we are now exiting the historic Covid downturn, oil is near ~$70 per barrel and the supply chain and labor shortages will fade as the global economy bounces back.

Financial health

Liberty reported a third-quarter 2021 loss per share of 22 cents. The underperformance is due largely to expenses related to acquiring and integrating the onshore hydraulic fracturing business it purchased from Schlumberger in January.

Liberty had approximately $35 million in cash and cash equivalents as of September 30, 2021. Its long-term debt of $122 million represented a debt-to-capitalization of 9.2%. Further, the company’s liquidity—cash balance, plus revolving credit facility—amounted to $268 million.

Zoom out, and Liberty has provided a 24% average cash return on capital invested over 9 years

Investment recommendation

I’ve invested my own money in Liberty because I have high conviction in its future growth prospects. I’m a long-term investor and plan to hold my investments for at least three to five years.

Your ultimate goal as an investor is to buy assets for less than they are really worth, and Liberty currently provides that opportunity. The volatility of the energy market allows investors to reap large returns, but make sure you have the right constitution to weather large swings in stock price before you jump into this pool.

Be patient and wait for the right price. If you decide to invest, consider reducing the risk by buying your desired position in four tranches. Look to buy your first investment-sized tranche below $11/share. Liberty is a growth stock and does not pay a dividend.

Current stock price near historic lows

Key Takeaways

- Liberty’s annual earnings are projected to grow nearly 80% over the next 3 years. Its current stock price (US~$10) is currently ~15% undervalued.

- Liberty is a tech company disguised as an oilfield services firm. Technology innovations are helping the company increase production, lower costs, and enhance ESG performance.

- Liberty has a strong founder/CEO with a proven track record.

- Natural gas will be the biggest winner in the energy sector over the next decade. The world is moving to natural gas because it’s reliable, affordable, and emits fewer greenhouse gases than the alternatives.

- Liberty is not immune to macroeconomic forces like higher transportation costs, driver scarcity, and labor shortages caused by Covid-19.

- ESG concerns and investor pressure may impact the cost of capital, which would put American oil and gas companies at a disadvantage.

- Liberty has provided a 24% average cash return on capital invested over 9 years.

My analysis is presented for general informational purposes and does not constitute investment advice. Do your own research. Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own due diligence before making investment decisions.